In today’s world, electronics and gadgets have become a vital part of our lives. Our life without our mobile phone is almost unimaginable. The same goes for other basic electronic devices like refrigerators, LED lights, televisions, air conditioners and many more such devices.

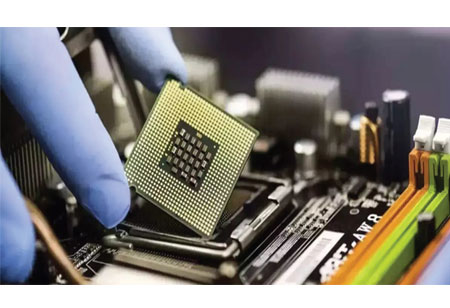

To make these devices we need people, machinery and raw materials but the most important thing is a semiconductor chip or integrated circuit. However, not many countries or companies can produce these semiconductors. To manufacture them, high-end precision computers and state-of-the-art machinery are required, but both of them are not very easily accessible. On top of that, it is crucial to have dedicated facilities with no contamination because even a small particle of dust can make the chip useless. Taiwanese company, TSMC (Taiwan Semiconductor Manufacturing Company) is the biggest semiconductor manufacturer in the world by a margin. As of 2023, its market share in the semiconductor industry is more than 59%. Because TSMC is such a big contributor to the world semiconductor market, dependency on it poses a threat.

This is where India’s first semiconductor manufacturing company, Polymatech comes in. Polymatech is planning on seizing this opportunity and making a significant place in the industry. They are vowing to invest $1 billion in their company to increase its manufacturing capabilities. Let’s see what they have in mind.

About Polymatech Electronics

Polymatech Electronics was founded in 2007 by Eswara Rao Nandam. Polymatech was formerly a Japanese company and it aspires to become the biggest semiconductor manufacturer in Asia by 2025. The company is based out of Chennai and at present, it has the ability to manufacture 300 million opto-semiconductor chips in a year. Although they plan to take this number up to 10 billion chips in a year by 2024. The company currently own two state-of-the-art fully operational and one non-operable plant. Polymatech is not listed anywhere and the only way to buy unlisted shares of Polymatech is through the grey market. In recent times Polymatech Electronics share price has gone up in the grey market.

Polymatech’s $1 bn dollar investment plan

Polymatech is planning on investing $1 billion in its company to maximise its semiconductor manufacturing capabilities by 2025. This will reduce India’s dependency on foreign imports of semiconductors and will help the country to be self-reliable. The investments will be in forward and backwards integration of their current offerings and in the indigenisation of products that are presently being imported.

This will be a great execution of the government’s Make in India and Digital India campaign. As we mentioned above, the current manufacturing capacity of Polymatech is 300 million chips per year but they intend to make 10 billion chips per year by 2025.

In addition to manufacturing semiconductors indigenously, Polymatech also plans on manufacturing the raw material required to make semiconductor chips. According to the founder of Polymatech Electronics, Eswara Rao Nandam, two major components for making semiconductor chips are silver paste and high-temperature co-fired ceramic substrate. Both of these things are currently being imported to India in order to make semiconductors, but to be fully self-dependent, we have to produce the raw materials too. Polymatech is also planning on manufacturing these components in India for a truly self-reliable ecosystem. The president of Polymatech, Eswara Rao Nandam, said that the company will produce these components independently in around 18 months, this will be a great achievement for India. The company’s major market is automobile companies. The president of Polymatech said, “We have a lot of inquiries from the automobile industry. Many companies are approaching us. We will start supplying the automobile industry this year”. The effects of these announcements can also be seen in Polymatech unlisted share price.

What does it mean for the investors?

This can be a very good opportunity for Indian reatil investors as Polymatech is not yet listed on NSE or BSE and the only way you can buy unlisted shares is through the grey market. In recent years Polymatech unlisted share prices have seen a hike and this shows that the company’s financial numbers are good. On top of that, the Indian government announced a ₹76,000 crore package to incentivise semiconductor manufacturing in India which means that the semiconductor industry has the government’s backing and it’s extremly unlikely that Polymatech Electronics share price will fall. If you want to buy unlisted shares of Polymatech then this is the right time. Previous record shows that the company is on its way up and sooner or later its IPO is gonna be announced, which would really benefit you if you have its unlisted shares.

That being said, make sure you go through all the company’s financial reports to ensure that you don’t make a bad decision. If you have a problem finding these reports then you should visit Stockify. It is a trusted online trading platform which provides you with all the necessary documents to evaluate a company’s unlisted share. Stockify also provides a trading platform that is safe and easy. Contact expert brokers today.